How the Most Progressive Countries Fund Their Welfare States, Part II: Just About Everyone Helps Out — HOME

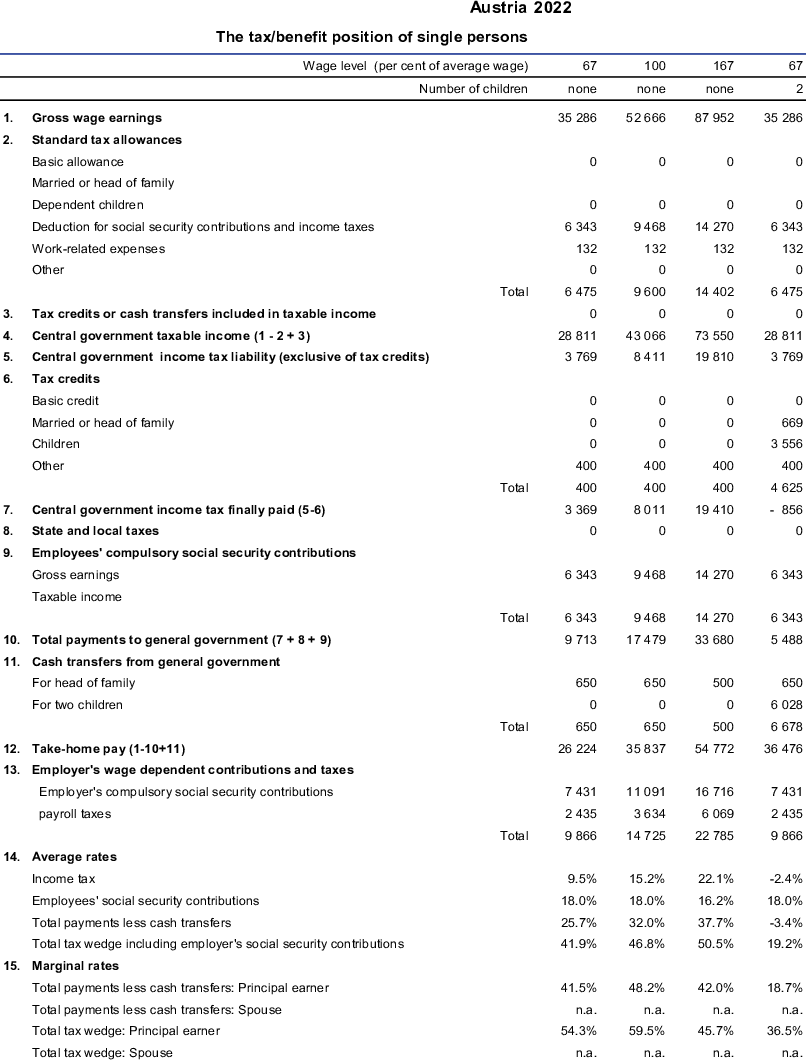

Austria | Taxing Wages 2023 : Indexation of Labour Taxation and Benefits in OECD Countries | OECD iLibrary

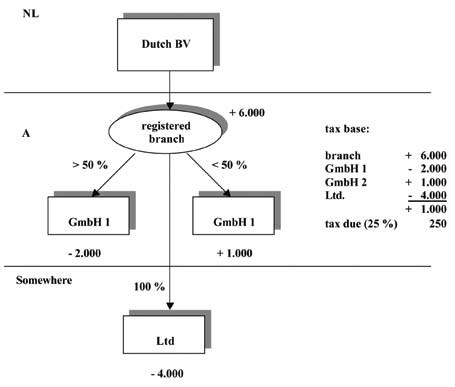

EC Court of Justice, 15 July 20041 Case C-315/02 Anneliese Lenz v Finanzlandesdirektion für Tirol Austrian legal background

In Tax, Gender Blind is not Gender Neutral: why tax policy responses to COVID-19 must consider women – ECOSCOPE

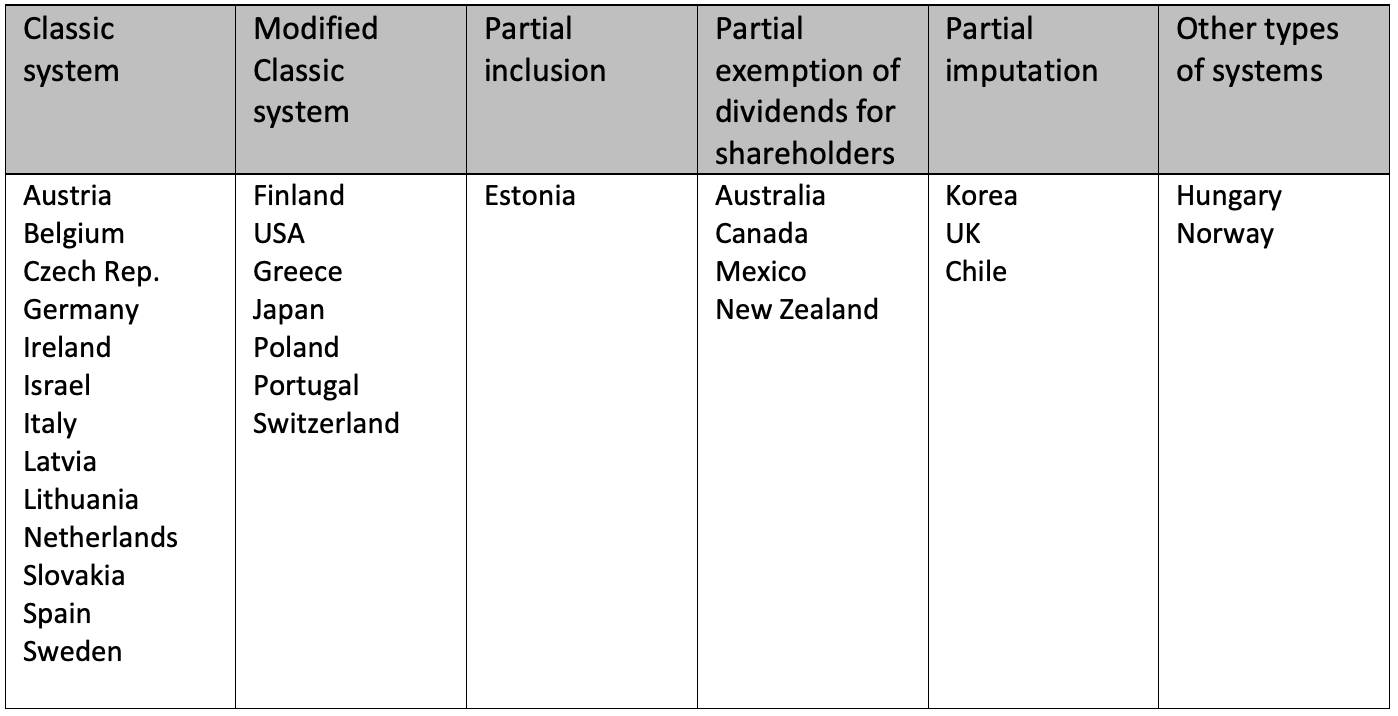

Differences in tax system in Poland and in German speaking countries Germany, Austria, Switzerland. - ppt download

Interaction of household income, consumption and wealth – statistics on taxation - Statistics Explained