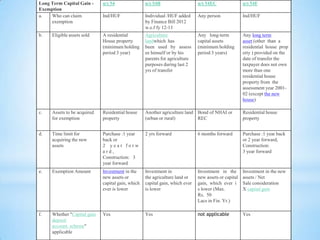

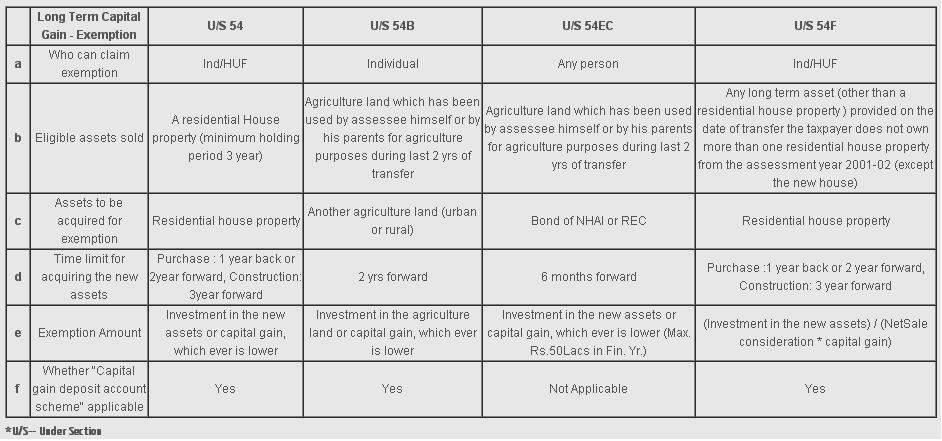

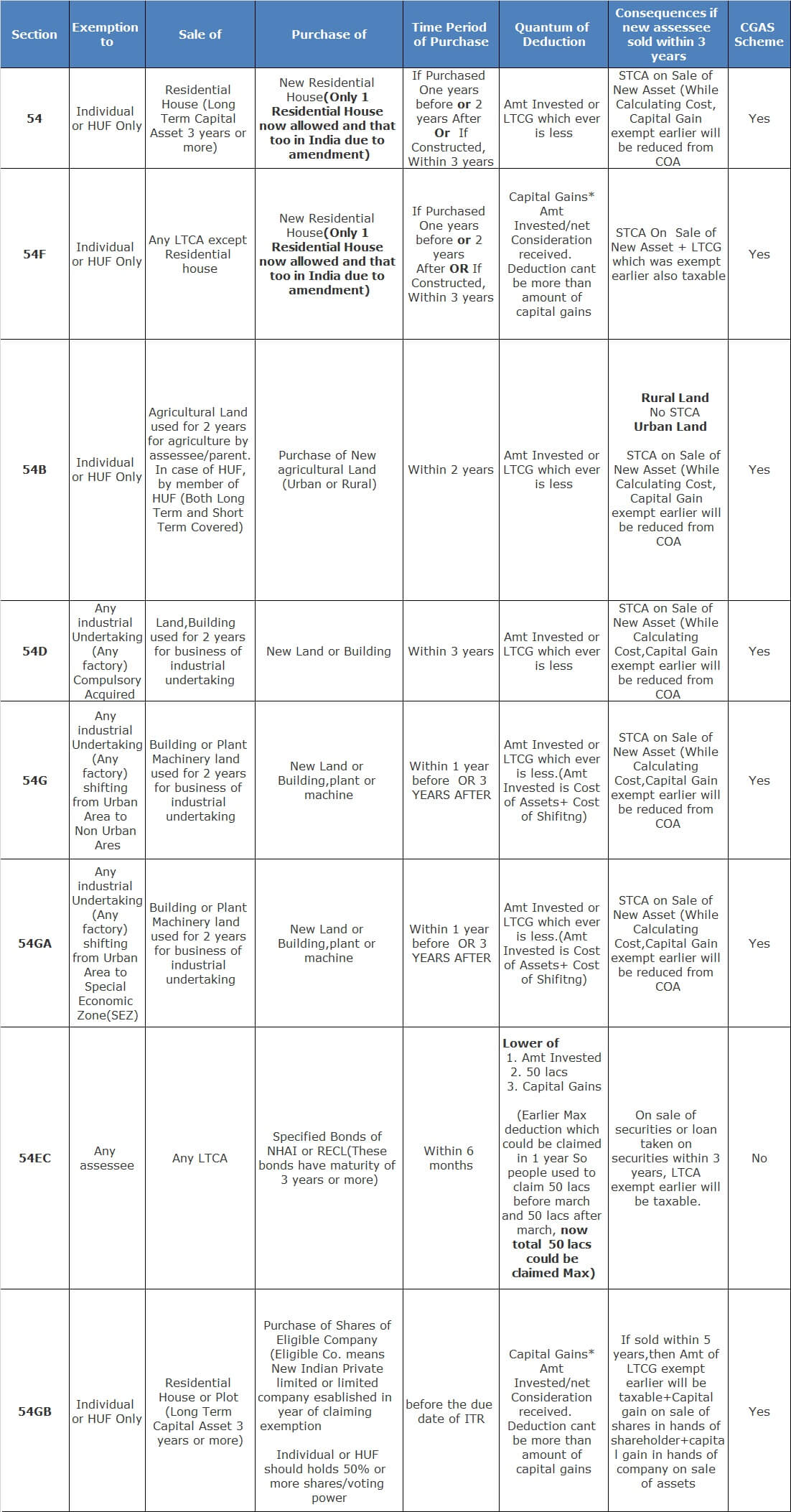

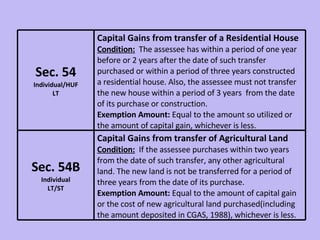

How To Claim Exemptions From Long Term Capital Gains - TOP CHARTERED ACCOUNTANT IN AHMEDABAD,GUJARAT,INDIA|TAX FILING|INCOME TAX|GST REGISTRATION|COMPANY FORMATION|AUDIT SERVICES|ACCOUNTING|TAX CONSULTANCY|BEST CA IN AHMEDABAD

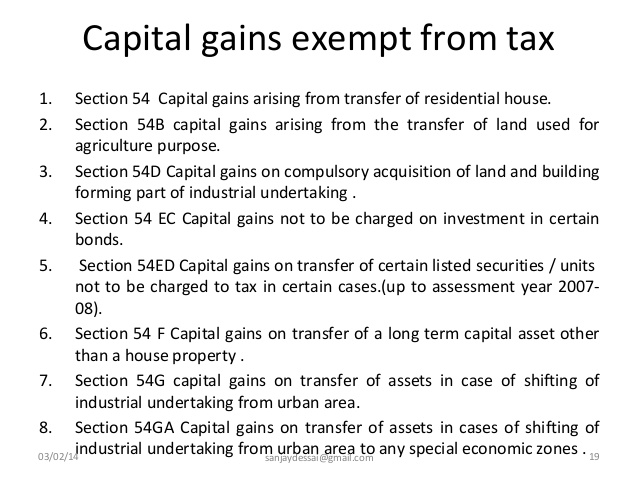

CAPITAL GAINS. INTRODUCTION CAPITAL GAINS “Any profit or gains arising from the transfer of capital assets is taxable under the head capital gains in. - ppt download